14th -15th April Important Events

14th -15th April Important Events : 01.

Juice spacecraft successfully launched to explore Jupiter’s icy moons

- Juice is a mission launched by the European Space Agency (ESA) on April 13, 2023, from its spaceport in French Guiana using an Ariane 5 launcher.

- The mission aims to explore Jupiter and its three largest icy moons, which are potentially habitable environments.

- The Juice mission will make detailed observations of Jupiter and its three large ocean-bearing moons using remote sensing, geophysical, and in situ instruments.

- Scientists believe that Ganymede, the largest moon in the Solar System, is the most interesting target for exploration because it generates its magnetic field.

- Juice will measure Ganymede’s rotation, gravity, shape, interior structure, magnetic field, and composition to a depth of about nine km.

- The mission also aims to create a comprehensive picture of Jupiter and understand its origin, history, and evolution.

- Juice will study the chemistry, structure, dynamics, weather, and climate of Jupiter and its ever-changing atmosphere.

- The industrial consortium led by Airbus Defence and Space built Juice based on parameters provided by the ESA.

- Only two other spacecraft have ever examined Jupiter: the Galileo probe, which orbited the gas giant between 1995 and 2003, and Juno, which has been circling the planet since 2016.

- NASA’s Europa Clipper spacecraft is also scheduled to orbit Jupiter by 2030 to study its Europa moon.

14th -15th April Important Events : 02

India’s forex reserves rise $6.30 billion to $584.75 billion

- India’s forex reserves increased by USD 6.306 billion to USD 584.755 billion for the week ended April 7, as per the RBI.

- In the previous reporting week, the forex reserves had decreased by USD 329 million to USD 578.45 billion.

- The country’s forex reserves reached an all-time high of USD 645 billion in October 2021 but have been declining due to the central bank’s efforts to defend the rupee.

- Foreign currency assets, a significant component of the reserves, rose by USD 4.74 billion to USD 514.431 billion for the week ended April 7.

- The foreign currency assets include the impact of appreciation or depreciation of non-US units such as the euro, pound, and yen held in the forex reserves.

14th -15th April Important Events : 03

NISAR satellite to map Himalayas’ seismic zones

Scientists and stakeholders from across India gathered in New Delhi to discuss earthquake preparedness in the country. Here are the key takeaways from the workshop:

- Accurately mapping earthquake-prone areas using the NISAR satellite: Scientists are using the NISAR spacecraft to identify areas where the strain is building up for a potential earthquake. The satellite can track small changes in plate tectonics and update plate deformation data every 12 days, which can be used by scientists to calculate strain in different parts of the country.

- Microzonation exercise: The National Centre for Seismology is undertaking a microzonation exercise to identify earthquake zones at a more granular level, which can help people build structures accordingly. This mapping exercise was already completed for major metros like Delhi and Kolkata.

- Glacial lake outburst flood (GLOF): Scientists discussed natural disasters that are an indirect result of earthquakes, such as GLOFs or landslides in the Himalayas. GLOFs take place when the water overflows from a lake formed by the melting of a glacier, which is held by a natural dam made of rocks and sediments known as a moraine. An earthquake can destabilize the dam that is holding the water in the lake.

- Draining out Himalayan glacial lakes: Ashim Sattar, a scientist at IISc, proposes that bringing down the water level of the lake by draining it out with pipes can prevent major disasters. He is working on identifying Himalayan glacial lakes at the risk of GLOFs. To recover the cost of such projects, Sattar says that the water drained from these lakes could be used to generate hydropower.

- Seismic hazard zones: India’s seismic zoning map classifies the total area into four seismic zones: V, IV, III & II. Zone V is seismically the most active region, while zone II is the least.

- Retrofitting buildings: A high percentage of buildings in India were found to be unsafe constructions. Kamal Kishore, a member secretary of the National Disaster Management Authority (NDMA), suggested that even retrofitting older buildings can have a huge impact on saving lives.

- Strengthening outreach activities: The workshop concluded with a call to strengthen outreach activities. Scientists need to work on developing new models and identifying earthquake precursors that can help predict earthquakes. Even a few seconds of early warning could end up saving lives.

14th -15th April Important Events : 04

RBI Pauses Policy Rate Hike Amidst Inflation Targeting Framework

The Evolution of Inflation Targeting in India

Introduction: Recently, the Indian central bank surprised the market by pausing its consecutive rate hikes despite inflation still beyond tolerance levels and downside risks from global economic activity. This edition of the burning issue will talk about this hike pause and the mechanism of inflation targeting.

Phase One: Non-Statutory Inflation Control By RBI

- Non-statutory mechanism included changes in policy rates such as cash reserve ratio and statutory liquidity ratio to maintain inflation.

- Limitations included lack of transparency in decision-making and uncertainty in the market about rates and inflation.

Phase Two: The MPC and The Beginning of the Inflation Targeting Era

- Monetary policy committee (MPC) was formed under Section 45ZB of the amended (in 2016) RBI Act, 1934.

- Six-member committee decides key policy rates.

- The primary objective is to maintain price stability while keeping in mind the objective of growth.

- The MPC determines the Policy Rate required to achieve the inflation target.

Monetary Policy Committee (MPC) and Inflation Targeting in India

I. Monetary Policy Committee (MPC)

- Definition: The central bank’s policy about the use of monetary instruments to achieve specific goals

- Committee formation: Six-member committee under Section 45ZB of the amended RBI Act, 1934

- Primary objective: Maintain price stability while considering growth

- Key policy rates decision-making: MPC’s responsibility

- Objective: Determine the Policy Rate required to achieve the inflation target

- Flexible Inflation Targeting Framework: Implemented in India after the 2016 amendment to the RBI Act

II. Inflation Targeting

- Definition: Central banking policy for adjusting monetary policy to achieve a specified annual rate of inflation

- First adopted by New Zealand, followed by 33 other countries

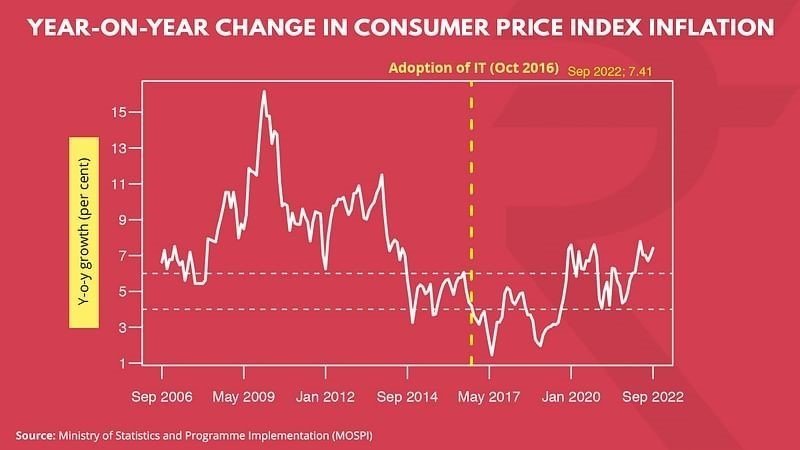

- India adopted in 2016

- The amended RBI Act, 1934 provided for the inflation target (4% +-2%) set by the Government of India in consultation with the RBI every five years.

RBI’s Stances under Inflation Targeting

I. Introduction

- The Reserve Bank of India (RBI) uses inflation targeting as its primary monetary policy framework.

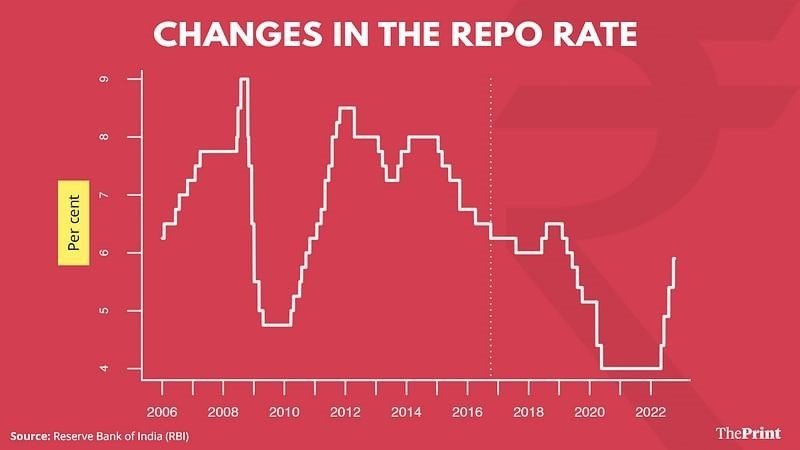

- The RBI’s monetary policy stance is reflected in its repo rate, which is the rate at which commercial banks can borrow from the central bank.

II. Accommodative Stance

- The central bank is willing to expand the money supply to boost economic growth.

- During an accommodative policy period, the central bank is willing to cut interest rates, ruling out a rate hike.

III. Neutral Stance

- The central bank can either cut or increase the interest rate.

- This stance is adopted when policy priority is equal on both inflation and growth.

IV. Hawkish Stance

- The central bank’s top priority is to keep inflation low.

- During a hawkish phase, the central bank is willing to hike interest rates to curb the money supply and reduce demand.

Link between Inflation and Rate Hikes

- Commercial banks borrow money from the central bank, which is repaid according to the repo rate.

- The central bank provides short-term loans against securities to control inflation or increase bank liquidity.

- The government increases the repo rate to control prices and restrict borrowing.

- An increase in the repo rate means commercial banks have to pay more interest, affecting public borrowings such as home loans and EMIs.

- Various financial and investment instruments are indirectly dependent on the repo rate.

Why RBI hiked rates previously?

- Global economic volatility due to the Ukraine war since March 2022 and supply chain disruptions for several items.

- Record high inflation throughout a major period during 2022 has prompted the RBI to make multiple policy rate hikes.

- The RBI has raised the repo rate by 250 basis points (bps) since May 2022, thereby increasing the External Benchmark Linked Interest Rates, EBLR by 250 bps.

- Banks have also raised the lending rate linked to the marginal cost of funds-based lending rate (MCLR) in the past 11 months.

- Last year, the Consumer price index (CPI) hit its highest of 7.79% in Apr, and the wholesale price index (WPI) reached 15.88% in May 2022.

Why RBI has now paused hikes?

- Decreasing inflation: The country’s retail inflation, which is measured by the Consumer price index (CPI), slipped to a 16-month low of 5.66% in Mar. 2023.

- Inflation data on the Wholesale Price Index (WPI), which calculates the overall prices of goods before selling at retail prices, was at 3.85% in Feb. 2023.

- May slow down growth and consumption: Concerns over slowing consumption and tepid private investment have been emerging in policy quarters, with many seeing high-interest rates as a crucial factor in dampening demand.

- Decrease in crude prices: Also, there has been a decrease in global crude prices and food inflation.

- Still risks are there: The RBI underlined risks from protracted geopolitical tensions, tight global financial conditions, and global financial market volatility to its monetary policy outlook.

Will this pause be helpful or not?

- Yes: The pause by the RBI will help favor the growth-inflation tradeoff towards the former.

- An increase in EMIs for different types of loans will also halt helping the middle class cope with inflation.

- No: Rates to remain high in the backdrop of many global agencies lowering India’s growth forecasts for this financial year amid expectations of global economic slowdown and monetary tightening by other countries.

- No relief on debts: The interest rates of debts are already high and a pause on a hike will not bring down these interest rates and thus keep the debt costlier.

Effectiveness of Inflation Targeting

Successes

- Average inflation has declined: The average inflation rate measured through the GDP deflator has declined significantly in the inflation targeting regime.

- The average inflation, which was 5.69 percent five years in the pre-inflation targeting period, has declined to 3.47 percent in the last five years.

- CPI declined: Consumer Price Index inflation declined from 8.26 percent during the 2011-2015 period to 4.99 percent in 2016-2019, a 3.27 percentage point fall.

- Enhanced transparency: Monetary policy transparency in India has improved after the adoption of the inflation-targeting framework.

Failures

- Sole focus of inflation: However, some critics of inflation targeting feel that its sole focus on price stability ignores growth imperatives.

- Not much effective in India: In India, the agricultural sector and informal economy have a large share, which is not directly impacted by such rate hikes, thus rendering the hikes less effective.

Way forward

- The review committee should try to find out areas of further improvement in the monetary policy framework which will strengthen the MPC to achieve the inflation target.

- In the present framework, it is not clear which model the RBI uses to forecast inflation and GDP figures, so it should disclose the models used in forecasting as other inflation-targeting countries do.

- Further, the RBI may include a forecast of core inflation in the minutes.

For more such updates checkout our daily current affairs