Important Events held on 14th and 15th May

Government’s New GST Compliance Measures

⦁ Lowering of Threshold for e-Invoicing:

⦁ The threshold for businesses to generate e-invoices for B2B transactions under GST has been lowered from Rs 10 crore to Rs 5 crore.

⦁ The change will be effective from August 1.

⦁ Previously, businesses with a turnover of Rs 10 crore and above were required to generate e-invoices for B2B transactions.

⦁ Automated Return Scrutiny Module:

⦁ The government will introduce an automated return scrutiny module for GST returns.

⦁ This module will enable officers to scrutinize GST returns of selected taxpayers based on data analytics and identified risks.

⦁ Discrepancies related to return risks will be identified and displayed to tax officers.

⦁ Tax officers will communicate discrepancies to taxpayers through the GSTN common portal and take necessary actions, such as issuing acceptance orders, show cause notices, or initiating audits/investigations.

⦁ The module has already started scrutinizing GST returns for the financial year 2019-20.

Significance and Implications:

⦁ Boosting Compliance and Curbing Tax Evasion:

⦁ These measures aim to increase compliance and curb tax evasion under the GST regime.

⦁ Lowering the e-invoicing threshold will broaden the compliance mandate for businesses, including small and medium enterprises.

⦁ The automated return scrutiny module will help identify discrepancies and take appropriate actions, ensuring better compliance.

⦁ Increasing GST Revenue Collections:

⦁ The reduction in the e-invoicing threshold is expected to boost GST revenue collections.

⦁ By capturing real-time data through e-invoicing, tax authorities can monitor transactions more effectively and detect potential frauds.

⦁ The automated return scrutiny module will assist in identifying tax evasion cases, leading to enhanced revenue collections.

⦁ Standardization and Reconciliation:

⦁ E-invoicing ensures a common standard for all invoices across the GST ecosystem.

⦁ It enables interoperability and reduces reconciliation issues for both taxpayers and tax authorities.

⦁ With pre-populated returns based on e-invoicing data, the chances of errors and mismatches in filing returns are minimized.

⦁ Impact on Small Businesses:

⦁ The lowering of the e-invoicing threshold to Rs 5 crore increases compliance requirements for smaller businesses.

⦁ These businesses will need to implement e-invoicing systems and adhere to the new threshold, which may require adjustments in their processes and systems.

Overall, these new GST compliance measures aim to enhance transparency, streamline processes, and strengthen the effectiveness of tax administration in India.

India’s Trade Performance in 2022-23: Services Boost Exports While Merchandise Trade Faces Challenges

India’s overall exports, including both merchandise and services, reached a record high of $770.18 billion in the fiscal year 2022-23, indicating a growth of 13.84%. However, overall imports surged by 17.38% to $892.18 billion, resulting in a merchandise trade deficit of $266.78 billion, a significant increase of over 39% compared to the previous year. The Ministry of Commerce and Industry released this data, highlighting the impact of a global economic slowdown on merchandise trade, while services exports experienced a robust growth of 26.79%.

Commerce Secretary Sunil Barthwal expressed satisfaction with the trade performance, surpassing the target of $750 billion for overall exports. He acknowledged the challenging global conditions but emphasized India’s ability to not only meet but exceed the export target. The information technology (IT) and IT-enabled services (ITES) sectors remain dominant contributors to services exports. However, the government aims to diversify and expand the list to include non-IT services, such as financial services and transport services, while also seeking improvements in tourism.

According to the Reserve Bank of India (RBI), computer services accounted for a significant portion of the trade surplus in services, amounting to $97 billion out of the $104.2 billion surplus from April to December. Professional and management consulting services followed at $29.2 billion. However, there were deficits in transport and travel services, while financial services showed a surplus.

The increase in merchandise imports to $714.24 billion, driven in part by a 29.5% rise in oil imports to $209.57 billion, contributed to the widening merchandise trade deficit. Despite a decline in China’s share of India’s import basket, it remained the largest source with imports worth $98.51 billion in 2022-23. Additionally, imports from Russia surged by 369.44% to $46.33 billion during the same period.

While 17 out of 30 major export sectors experienced growth, the overall increase in merchandise exports was 6.03%. However, experts have noted that weak global demand and a slowdown in H2 FY2023, along with moderating global commodity prices, impacted non-oil exports, which declined marginally by 0.5%. Aditi Nayar, Chief Economist at ICRA, predicts that these challenges will continue in FY2024, leading to a deeper contraction in India’s merchandise exports, affecting the manufacturing sector and GDP growth.

In conclusion, India’s trade performance in 2022-23 showcased robust growth in services exports, compensating for challenges faced by merchandise trade due to a global economic slowdown. The government aims to diversify the services export sector, focusing on non-IT services, while also addressing the trade deficit through measures such as quality control orders and Production Linked Incentive schemes to reduce non-essential imports. However, experts warn that weak global demand may impact future export growth.

First UK Baby with DNA from Three People Born after Groundbreaking IVF Procedure

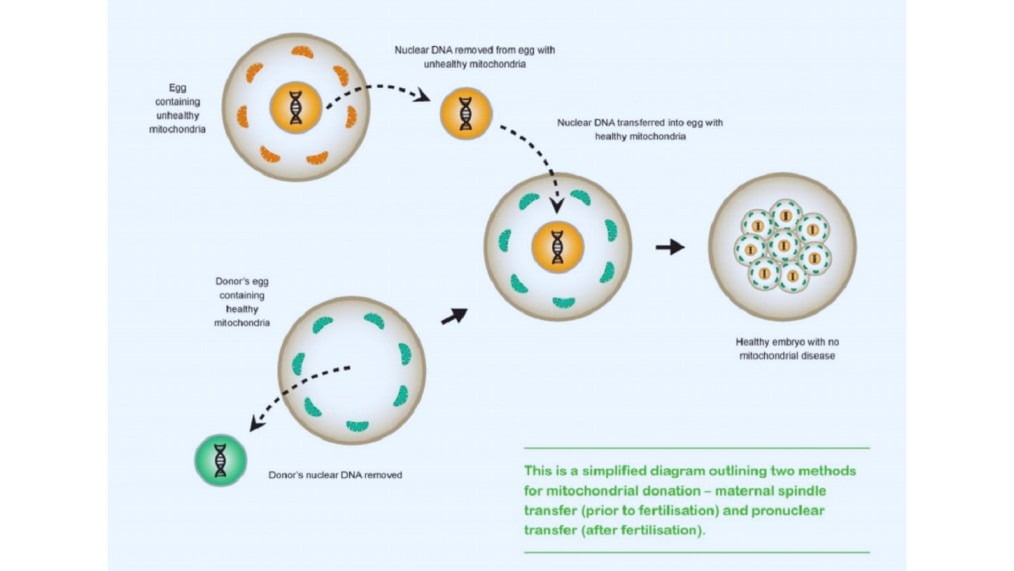

A groundbreaking in vitro fertilization (IVF) procedure has resulted in the birth of the first UK baby with DNA from three individuals. The innovative technique, known as mitochondrial donation treatment (MDT), aims to prevent the inheritance of incurable diseases by utilizing healthy tissue from female egg donors.

MDT involves the creation of IVF embryos using eggs from healthy female donors, which are free from harmful mutations carried by the mothers. By combining the sperm and egg from the biological parents with a small amount of genetic material (about 37 genes) from the donor’s egg, the resulting baby inherits DNA from both parents along with a small contribution from the donor.

While the term “three-parent babies” has been used to describe these babies, more than 99.8% of their DNA comes from the biological mother and father. The MDT research, also known as mitochondrial replacement therapy (MRT), was pioneered by doctors at the Newcastle Fertility Centre in the UK. Its primary goal is to assist women with mitochondrial mutations in having children without the risk of passing on genetic disorders. Mitochondria, responsible for providing energy to cells, are inherited solely from the mother, and any harmful mutations can affect all the children she bears.

For women with mitochondrial mutations, natural conception is often uncertain, as some babies may inherit only a small proportion of the mutated mitochondria, while others can inherit a larger amount, leading to severe and potentially fatal diseases. Mitochondrial disorders affect approximately one in 6,000 babies.

The MDT procedure was authorized in the UK in 2015 following progress in research. The Newcastle clinic became the first and only national center licensed to perform the procedure in 2018, with approval granted on a case-by-case basis by the Human Fertilisation and Embryology Authority (HFEA). As of late April 2023, the HFEA confirmed that fewer than five babies have been born in the UK following MDT, with precise figures withheld to protect patient confidentiality.

Although the COVID-19 pandemic caused significant delays in the treatment program, with some potential donors and couples opting out, the Newcastle process involves multiple steps. Sperm from the father is used to fertilize eggs from the affected mother and a healthy female donor. The nuclear genetic material from the donor’s egg is then substituted with the couple’s fertilized egg, resulting in an egg with the full set of chromosomes from both parents but carrying the donor’s healthy mitochondria instead of the mother’s faulty ones. This modified egg is subsequently implanted in the mother’s womb.

While MDT offers hope to families affected by severe inherited mitochondrial illnesses, it is not without risks. Recent research has revealed the possibility of reversion or reversal, where a small number of abnormal mitochondria carried over from the mother’s egg can multiply during fetal development, potentially leading to a disease in the child. Further understanding of the timing and mechanisms of reversal is needed.

Given the sensitive nature of the procedure and the experiences of families seeking MDT, it is crucial to employ a measured and carefully regulated approach. Long-term follow-up of children born through MDT is essential to assess the safety and efficacy of the treatment. The HFEA continues to review clinical and scientific developments in MDT.

In supporting open, independent journalism, we aim to provide high-quality, fact-checked reporting. By maintaining our paywall-free model, we uphold the right of everyone to access reliable news. Your support as a reader enables us to remain independent and dedicated to pursuing the truth. Please consider making a contribution, whether small or large, to power the Guardian’s reporting for years to come. Your commitment helps safeguard the free press and empowers an informed public.

Reserve Bank of India Launches 100-Day Campaign to Settle Unclaimed Deposits

The Reserve Bank of India (RBI) has announced a special campaign aimed at tracing and settling the top 100 unclaimed deposits in every district of the country. Scheduled to commence on June 1, 2023, this initiative seeks to address the issue of unclaimed deposits held by banks. The campaign was discussed during a meeting of the high-powered Financial Stability and Development Council (FSDC), chaired by Finance Minister Nirmala Sitharaman.

Unclaimed deposits refer to balances in savings or current accounts that have remained inactive for 10 years, as well as term deposits that have not been claimed within 10 years of maturity. Such deposits are classified as “unclaimed deposits,” and banks transfer these amounts to the “Depositor Education and Awareness” (DEA) Fund maintained by the RBI.

The RBI’s “100 Days 100 Pays” campaign mandates banks to trace and settle the top 100 unclaimed deposits of each bank in every district of the country within 100 days. This initiative complements the ongoing efforts by the RBI to reduce the amount of unclaimed deposits in the banking system and ensure that these funds are returned to their rightful owners or claimants.

In addition to the campaign, the RBI has announced the establishment of a centralized web portal that allows the public to search for unclaimed deposits across multiple banks. The central bank has been actively promoting public awareness regarding unclaimed deposits through various initiatives, encouraging individuals to identify and approach the respective banks to claim their funds.

As of February 2023, public sector banks (PSBs) have transferred a total of Rs 35,012 crore in unclaimed deposits to the RBI. The RBI’s measures, including the 100-day campaign and the centralized web portal, aim to address this issue and ensure that unclaimed deposits are reunited with their rightful owners.

Kandela IAS recognizes the value of keeping abreast of current events and offers a diverse range of courses to help you stay informed of the latest developments and trends. Kandela IAS team of experienced faculty members is committed to delivering top-quality education that equips you with the knowledge and skills necessary to succeed in your profession. Our blog post, “Important Events held on 14th and 15th May,” provides you with valuable information about significant happenings worldwide. Moreover, Kandela IAS provide comprehensive current affairs courses that encompass a broad range of topics, including politics, economics, sports, and entertainment.

So, if you want to achieve your career objectives, enroll in our courses today and take advantage of the learning opportunities we provide. And also Subscribe for our Youtube Channel Kandela IAS For more updates