Important Events held on 18th and 19th May

RBI issues framework for acceptance of green deposits by banks, NBFCs

Important Events held on 18th and 19th May – 01

- The Reserve Bank of India (RBI) has issued a framework for the acceptance of green deposits by regulated entities (REs) such as banks and non-banking financial companies (NBFCs).

- The purpose of the framework is to encourage REs to offer green deposits to customers and promote sustainability.

- The framework aims to protect the interests of depositors, aid customers in achieving their sustainability agenda, address concerns related to greenwashing, and increase credit flow to green activities and projects.

- The guidelines will be effective from June 1, 2023.

- Green deposits will be utilized for financing activities related to renewable energy, green transport, and green buildings.

- The allocation of proceeds raised from green deposits should be based on the official Indian green taxonomy.

- In the absence of a finalized taxonomy, REs will be required to allocate the funds to a specified list of green activities/projects.

- The specified projects/activities should focus on energy efficiency, reducing carbon emissions and greenhouse gases, promoting climate resilience and adaptation, and enhancing natural ecosystems and biodiversity.

- Projects involving extraction, production, and distribution of fossil fuels, nuclear power generation, and direct waste incineration are excluded from the green deposit framework.

- Banks and NBFCs must establish a comprehensive board-approved policy on green deposits.

Table of Contents

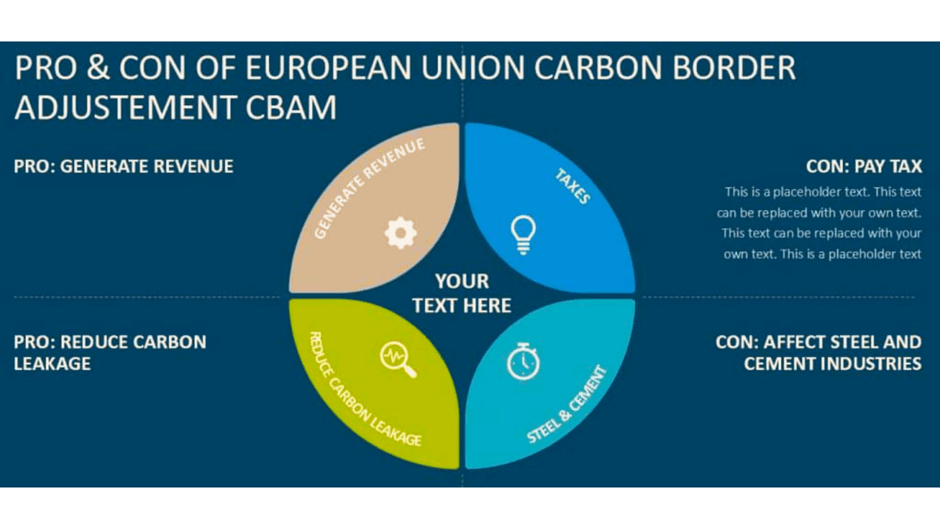

Implications of EU Carbon Border Adjustment Mechanism on Indian Businesses

Important Events held on 18th and 19th May – 02

Introduction:

- The EU has introduced the Carbon Border Adjustment Mechanism (CBAM) as part of its Green Deal initiative.

- CBAM aims to reduce greenhouse gas emissions and prevent carbon leakage by imposing a fee on the carbon emissions contained in specific imports.

Implementation and Phases:

- The European Parliament passed legislation for the implementation of CBAM on April 18, 2023.

- CBAM will be rolled out in four phases, with the Carbon Border Tax (CBT) becoming applicable from January 2026.

- The CBT will be imposed on imports of products like steel, aluminum, fertilizer, electricity, cement, and hydrogen.

Concerns and Criticisms from India:

- India, a developing country with a target of becoming carbon neutral by 2070, has expressed concerns about CBAM.

- India has raised objections to CBAM at international forums, including the World Trade Organization (WTO).

- The country emphasizes the importance of non-discriminatory treatment for similar products and warns about potential protectionist practices arising from CBAM.

Functionality of CBAM:

- CBAM ensures fair competition by addressing the carbon cost borne by EU installations under the EU Emissions Trading System (ETS) and imported products.

- It applies a fee on the carbon emissions in certain imports, equal to the fee imposed on domestic products under the ETS.

- The goal is to discourage companies from relocating their manufacturing operations outside the EU to evade climate regulations.

Implications for Indian Businesses:

- Indian manufacturing entities and exporters may face challenges due to the additional costs imposed by the carbon border tax.

- It could impact the competitiveness of Indian products in the EU market, potentially leading to reduced export volumes.

- Businesses in sectors like steel, aluminum, fertilizer, electricity, cement, and hydrogen may need to adapt their operations to comply with the EU’s carbon standards.

Business Actions to Prepare for CBAM:

- Assess the potential impact of CBAM on the business’s products and competitiveness in the EU market.

- Explore opportunities to reduce carbon emissions and improve energy efficiency to mitigate the impact of the carbon border tax.

- Engage in dialogue with EU counterparts, industry associations, and government bodies to advocate for fair treatment and address concerns regarding CBAM.

Overall, the EU’s Carbon Border Adjustment Mechanism poses trade restrictions that could impact Indian businesses. To prepare for the implementation of the carbon border tax, businesses should evaluate the implications, seek ways to reduce emissions, and engage in proactive communication and collaboration with relevant stakeholders.

- The transitional phase of the Carbon Border Adjustment Mechanism (CBAM) will be in effect from October 1, 2023, until December 31, 2025.

- During this phase, quarterly reports on greenhouse gas emissions of specific products imported into the EU will be required, covering both direct and indirect emissions.

- Starting from 2026, the purchase of CBAM certificates will be mandatory to cover GHG emissions.

- The cost of these certificates will be linked to carbon prices under the EU Emissions Trading System (ETS).

- CBAM will impose an additional cost on exporting to the EU market, which will be shared between the exporter or producer.

- This additional cost could impact the marketing strategies of exporters or producers.

- CBAM has drawn criticism from countries like China, India, some US industries, and many industries in developing countries.

- These countries rely heavily on coal-fired electricity, and the CBAM regulation could affect their manufacturing sectors.

- The regulation requires companies exporting iron, steel, fertilizers, or cement to the EU to calculate and pay for greenhouse gas and carbon emissions associated with each product.

- If the added cost cannot be absorbed, companies may have to explore trading with countries that do not have such a tax or revise their production methods to emit fewer greenhouse gases or carbon.

- While CBAM may benefit the environment, it could lead to supply chain fragmentation and increased costs.

- Businesses should carefully assess the potential impact of CBAM on their operations.

- They should also explore ways to become more environmentally sustainable in the long term to avoid disruptions to their business activities.

Products and Sectors Covered by CBAM:

- Iron and Steel: CBAM applies to the iron and steel industry, which is responsible for a significant amount of global carbon emissions.

- Cement: CBAM covers the cement sector, taking into account indirect emissions associated with cement production.

- Fertilizers: Only indirect emissions from the fertilizer industry are considered under CBAM.

- Aluminum: CBAM includes the aluminum industry, which is known for its high carbon intensity.

- Electricity: The scope of CBAM extends to the electricity sector, targeting carbon-intensive electricity generation.

- Hydrogen: CBAM also covers hydrogen production, particularly in relation to its carbon intensity.

- Precursors and Downstream Products: CBAM includes certain precursors and a limited number of downstream products in the covered sectors.

Timeline for Expansion:

The CBAM Regulation mandates the European Commission to establish a timeline for gradually integrating all products covered under the EU Emissions Trading System (EU ETS) into CBAM, including indirect emissions and emissions from international transportation, by 2030.

Impact on Indian Exports and Mitigation Strategies:

- Economic Impact: The implementation of CBAM by the EU is expected to have a significant economic impact on India’s exports of energy-intensive products such as steel, aluminum, cement, and fertilizers. Indian exporters may face higher prices, reduced competitiveness, and lower demand in the EU market.

- Steel Industry: The steel industry is considered a hard-to-abate sector and a major contributor to global emissions. The rise in steel demand and energy-intensive production processes have led to increased carbon emissions.

- Challenge to Indian Metal Sector: The CBAM implementation poses a significant challenge to India’s metal sector. In 2022, a substantial portion of India’s iron, steel, and aluminum exports went to the EU, and the CBAM will result in Indian firms paying a carbon tax on each consignment, potentially amounting to 20-35 percent of tariffs.

- Impact on Product Competitiveness: The impact of CBAM on Indian exports depends on the carbon intensity of the products and their substitutes in the EU market. Products with high carbon intensity may face higher charges, reducing their competitiveness. However, if low-carbon substitutes are not readily available in the EU market, the impact on Indian exports may be limited.

- Lack of Emissions Trading System: India’s lack of an emissions trading system like the EU ETS presents a challenge. Without such a system, it may be difficult for Indian businesses to demonstrate low-carbon production methods, potentially resulting in higher CBAM charges.

Mitigation Strategies:

- Carbon Pricing Mechanism: India needs to implement a carbon pricing mechanism to incentivize low-carbon production and provide a basis for demonstrating compliance with CBAM regulations.

- Development of Low-Carbon Technologies: To remain competitive, Indian businesses should invest in and develop low-carbon technologies to reduce the carbon intensity of their products.

- Export Strategy Review: India should review its export strategy and explore alternative markets where its products can remain competitive despite the impact of CBAM in the EU market.

Business Support:

Indian businesses can seek assistance with various aspects related to international trade and market entry strategies, such as business matchmaking, location analysis, market research, market entry strategy, and supply chain re-engineering in Asia.

Impact of CBAM on manufacturing in India:

- Increased tax burden: The EU’s Carbon Border Adjustment Mechanism (CBAM) may impose higher taxes on Indian manufacturers exporting products to the EU compared to their EU counterparts. This could reduce the competitiveness of Indian manufacturers and potentially shift demand towards EU-made products.

- Compliance requirements: Indian companies will need to comply with CBAM regulations, which may require them to provide data on carbon emissions associated with their products. This could create additional administrative burdens and compliance costs for manufacturers.

- Market disruption: The implementation of CBAM could disrupt the Indian manufacturing industry, as companies may need to reevaluate their export strategies and adapt to changing market dynamics. The shift in demand towards EU-made products may impact the growth and profitability of Indian manufacturers.

Mitigation strategies for Indian companies:

- Investment in renewable energy: Indian manufacturers can invest in renewable energy sources, such as solar and wind power, to reduce their carbon emissions. This will not only help them comply with CBAM requirements but also make their products more environmentally friendly and competitive in the EU market.

- Supply chain optimization: Companies can optimize their supply chain processes to reduce the carbon footprint of their products. This includes sourcing materials from sustainable suppliers, implementing energy-efficient manufacturing practices, and promoting recycling and waste reduction.

- Diversification of export markets: To reduce dependence on the EU market and mitigate the impact of CBAM, Indian companies can explore opportunities in other regions. By diversifying their export markets, they can minimize the potential loss of demand from the EU and maintain a stable customer base.

- Engaging with policymakers: Indian manufacturers should engage with policymakers, both in India and the EU, to provide inputs on the design and implementation of CBAM. By actively participating in policy discussions, they can influence the development of regulations that are fair and considerate of their specific challenges and capabilities.

Mitigation strategies for the Indian government:

- Negotiating with the EU: The Indian government can engage in negotiations with the EU to secure exemptions or reduced rates for Indian manufacturers under CBAM. This would help ensure that Indian companies are not disproportionately penalized for their emissions and maintain a level playing field.

- Development of a domestic carbon pricing mechanism: The government can work on establishing a domestic carbon pricing mechanism, incentivizing companies to reduce their emissions. This would align India’s policies with the EU’s carbon reduction goals and make Indian businesses more competitive globally.

- Promotion of renewable energy: The Indian government can continue promoting renewable energy sources, providing incentives and support for the adoption of solar, wind, and other clean energy technologies. This would facilitate the transition of Indian manufacturers to cleaner energy sources, reducing their carbon emissions.

- Investment in carbon capture technology: Exploring and investing in carbon capture and storage (CCS) technology can help Indian manufacturers reduce their carbon emissions. CCS captures CO2 emissions from manufacturing processes and stores them underground, minimizing their impact on the environment.

By implementing these mitigation strategies, both Indian companies and the government can navigate the potential impact of CBAM on the manufacturing industry, reduce carbon emissions, and maintain competitiveness in the global market.

Above Provided contents are Important Events held on 18th and 19th May

Kandela IAS recognizes the value of keeping abreast of current events and offers a diverse range of courses to help you stay informed of the latest developments and trends. Kandela IAS team of experienced faculty members is committed to delivering top-quality education that equips you with the knowledge and skills necessary to succeed in your profession. Our blog post, “Important Events held on 18th and 19th May,” provides you with valuable information about significant happenings worldwide. Moreover, Kandela IAS provide comprehensive current affairs courses that encompass a broad range of topics, including politics, economics, sports, and entertainment.

So, if you want to achieve your career objectives, enroll in our courses today and take advantage of the learning opportunities we provide. And also Subscribe for our Youtube Channel Kandela IAS For more updates

At Kandela IAS, we understand the importance of staying informed and up-to-date with current events. Whether you are a professional aiming for career growth or an individual seeking personal development, our comprehensive current affairs courses are designed to cater to your needs. We offer a diverse range of topics, including politics, economics, sports, and entertainment, ensuring that you gain a holistic understanding of the world around you.

By enrolling in our courses, you will have access to experienced faculty members who are dedicated to delivering top-quality education. Our faculty brings a wealth of knowledge and expertise, providing you with valuable insights and perspectives on the latest developments and trends. Through engaging lectures, interactive discussions, and practical exercises, we aim to equip you with the knowledge and skills necessary to succeed in your profession.

Our blog post, “Important Events held on 18th and 19th May,” serves as a preview of the kind of valuable information and insights you can expect from our courses. In this blog post, we highlight significant happenings worldwide during those specific dates. By reading this post, you will get a glimpse of the type of content we cover and the depth of analysis we provide.

To stay even more updated with the latest developments, we encourage you to subscribe to the Kandela IAS YouTube channel. Our YouTube channel offers additional resources, including video lectures, expert interviews, and informative discussions on various current affairs topics. By subscribing, you will have access to a wealth of information that complements our courses, enabling you to expand your knowledge base further.

In today’s dynamic world, it is crucial to be well-informed and adaptable. By taking advantage of the learning opportunities provided by Kandela IAS, you can effectively achieve your career objectives. Whether you aspire to excel in the corporate world, government services, or any other profession, our courses will empower you with the necessary knowledge and skills to navigate the complexities of the modern landscape.

Enroll in our courses today and embark on a journey of continuous learning and growth. Stay informed, stay ahead, and unlock your full potential with Kandela IAS.